how do i get my employer to withhold more tax

On the other hand if you want less in tax taken out. Either the single rate or the lower married rate.

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Once youve used the Tax Withholding Estimator tool you can use the results of the calculator to fill out a new Form W-4.

. It depends on. An employee may request a variation to increase or decrease the amount of tax you withhold from them. The amount of income earned and.

For more information visit. Thats the amount you are telling the IRS shouldnt be taxed on your income. 6672 a imposes a 100 civil penalty on the responsible officers and a felony penalty for failure to comply with employment tax obligations.

The information you give your employer on Form W4. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. Employers currently withhold and remit employees taxes on wage and salary income according to the following schedule.

Because of this both you and your employees should be on the lookout for changes in tax law. The first step is filling out your name address and Social Security number. How to Adjust Your Tax Withholding.

The amount you earn. Make your payments on time. Enter your personal information.

The withholding amounts are used to pay child support spousal support medical support or other types of support. 145 Medicare tax withheld on all of an employees wages. If you have no employer to withhold federal taxes then youre responsible for withholding your own.

1 They may make quarterly estimated tax payments totaling 100 of their previous years tax liability. For help with your withholding you may use the Tax Withholding Estimator. The Withholding Form.

But before you do that experts recommend doing a little legwork to determine which tweaks are necessary. If passed this could help future workers disrupted by lockdowns. If the variation reduces the amount.

Coordinate this effort with your spouse if you are filing as married filing jointly on your next tax return. Reduce the number of dependents or add an extra amount to withhold on line 4c. How many withholding allowances you claim.

According to the New York State Child Support Agency income withholders such as. Filing status such as single head of household or married filing jointly. Complete the About You section.

Here are the steps to calculate withholding tax. FICA mandates that three separate taxes be withheld from an employees gross earnings. Currently three Code sections can be implicated in an employers failure to withhold taxes.

The Senates Remote and Mobile Worker Relief Act of 2021 would stop states from withholding taxes for nonresident employees who are only in the state for 30 days or less. Give it to your employers human resources or payroll department and theyll make the necessary adjustments. Im just a regular individual with some complicated taxes to the extent that about 20 of my salary goes to my tax accountant.

Multiple jobs or spouse works. TurboTax cant handle it and the cheaper tax preparers Ive used in past years made mistakes that cost me a fortune and years of my life to unwind. Until the employee furnishes a new Form W-4 the employer must withhold from the employee as from a single person.

First gather all the documentation you need to reference to calculate withholding tax. 62 Social Security tax withheld from the first 142800 an employee makes in 2021. If you want more tax taken out of your paycheck which could result in a higher tax refund.

Details of the additional amounts to withhold are included in the tax tables. You can ask your employer for a copy of this form or you. Whether you or your spouse will receive income from a pension this year.

An income withholding order IWO is an order that directs you the employer to withhold a specific amount from the paychecks of an employee. Monthly If total withholding is 300 to 999 per quarter the taxes are due the 15th day of. Ideally you want to pay at least 90 of your owed tax throughout the year.

Factor in additional income and deductions. Mail email or hand it over to your employer s not the IRS or state agency. Three types of information an employee gives to their employer on Form W4 Employees Withholding Allowance Certificate.

I heard my employer no longer has to routinely submit Forms W-4 to the IRS. If you withhold at the single rate or at the lower married rate. To adjust your withholding youll need to fill out a new W-4 tax form.

Refer to Publication 15 Employers Tax Guide and Publication 15-A Employers Supplemental Tax Guide for more information on. Number of withholding allowances claimed. You pay FUTA tax only from your own funds.

Answer five questions about yourself including. Each allowance you claim reduces the amount withheld. It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA.

If however a prior Form W-4 is in effect for the employee the employer must continue to withhold based on the prior Form W-4. Number of jobs you and your spouse hold. Fill Out a New Form W-4.

Employers report and pay FUTA tax separately from Federal Income tax and social security and Medicare taxes. The amount of income tax your employer withholds from your regular pay depends on two things. Quarterly If total withholding is under 300 per quarter the taxes are due the last day of April July October and January.

Each withholding allowance claimed is equal to 4200 of your income for 2019. But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit. Im very sorry.

Determine if estimated tax payments are necessary. A good first stop. Its the federal law that requires employers to pay and withhold certain taxes from the wages they pay employees.

How withholding is determined. 2 They may make quarterly estimated tax payments totaling 90 of the current years. In order to adjust your tax withholding you will have to complete a new W-4 form with your employer.

Schedule 1 - Statement of formulas for calculating amounts to be withheld. The amount of income you earn. The TCJA eliminated the personal exemption.

For employees withholding is the amount of federal income tax withheld from your paycheck. 7202 makes failure to comply with employment tax obligations a felony punishable by up to five. Employees do not pay this tax or have it withheld from their pay.

Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. The withholding tax amount depends on a number of factors so youll need the employees W-4 to help with your calculations as well as the withholding tax tables and the IRS. This is not sustainable for my budget but unfortunately I cant do it myself eg.

Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate. The amount withheld depends on. For most situations its simply a matter of filling out the W4 form and submitting to payroll - but sometimes more work is needed.

An employers filing frequency for state income tax withholding is determined each calendar year by the combined amount of state and school district taxes that were withheld or required to be withheld during the 12-month period ending June 30 of the preceding calendar year ie total state and school district income tax withheld for 7119. Calculate the minimum estimated tax payment to make.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Federal Withholding Calculating An Employee S Federal Withholding By Using The Wage Bracket Method Youtube

How To Fill Out Form W 4 In 11 Steps Tax Forms The Motley Fool Job Application Form

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

Fillable Form W 4 Or Employee S Withholding Certificate Edit Sign Download In Pdf Pdfrun Online Taxes Federal Income Tax Tax Forms

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Form W 4 Employee S Withholding Certificate 2016 Mbcvirtual In 2022 Changing Jobs Income Tax Federal Income Tax

How Does An Employer Withhold Tax From An Employee Taxry

Generalcontractorbusiness Bookkeeping Business Small Business Accounting Business Tax

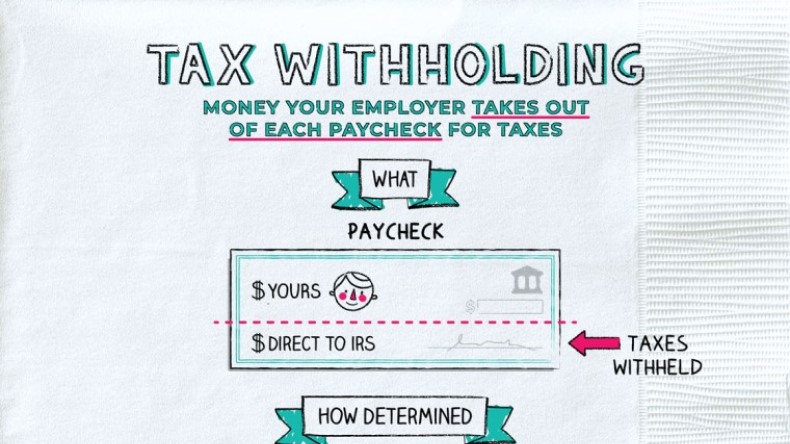

What Is Tax Withholding All Your Questions Answered By Napkin Finance

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

Irs Improves Online Tax Withholding Calculator Cpa Practice Advisor

Employer Withholding Department Of Taxation

What Is Tax Withholding All Your Questions Answered By Napkin Finance

What Are Payroll Taxes Employers Need To Withhold Payroll Taxes From Employee Wages And Self Employed People Need To Payroll Taxes Payroll Small Business Tax

Best Ways To Get The Most Money When You Fill Out Your W 4 Form Tax Forms W4 Tax Form Tax