is a car an asset for fafsa

You still need to list your bank account totals as an asset. How different assets are reported on the FAFSA.

Fafsa Tips 7 Ways To Get More Financial Aid Money

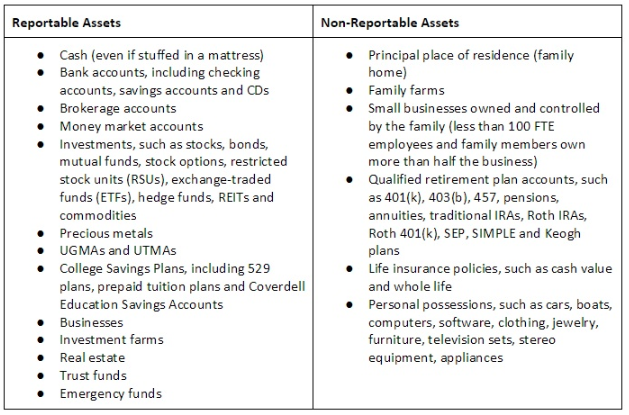

The FAFSA doesnt want to know about assets in a farm if it is the familys principal residence and the student andor parents materially participate in the farming operation.

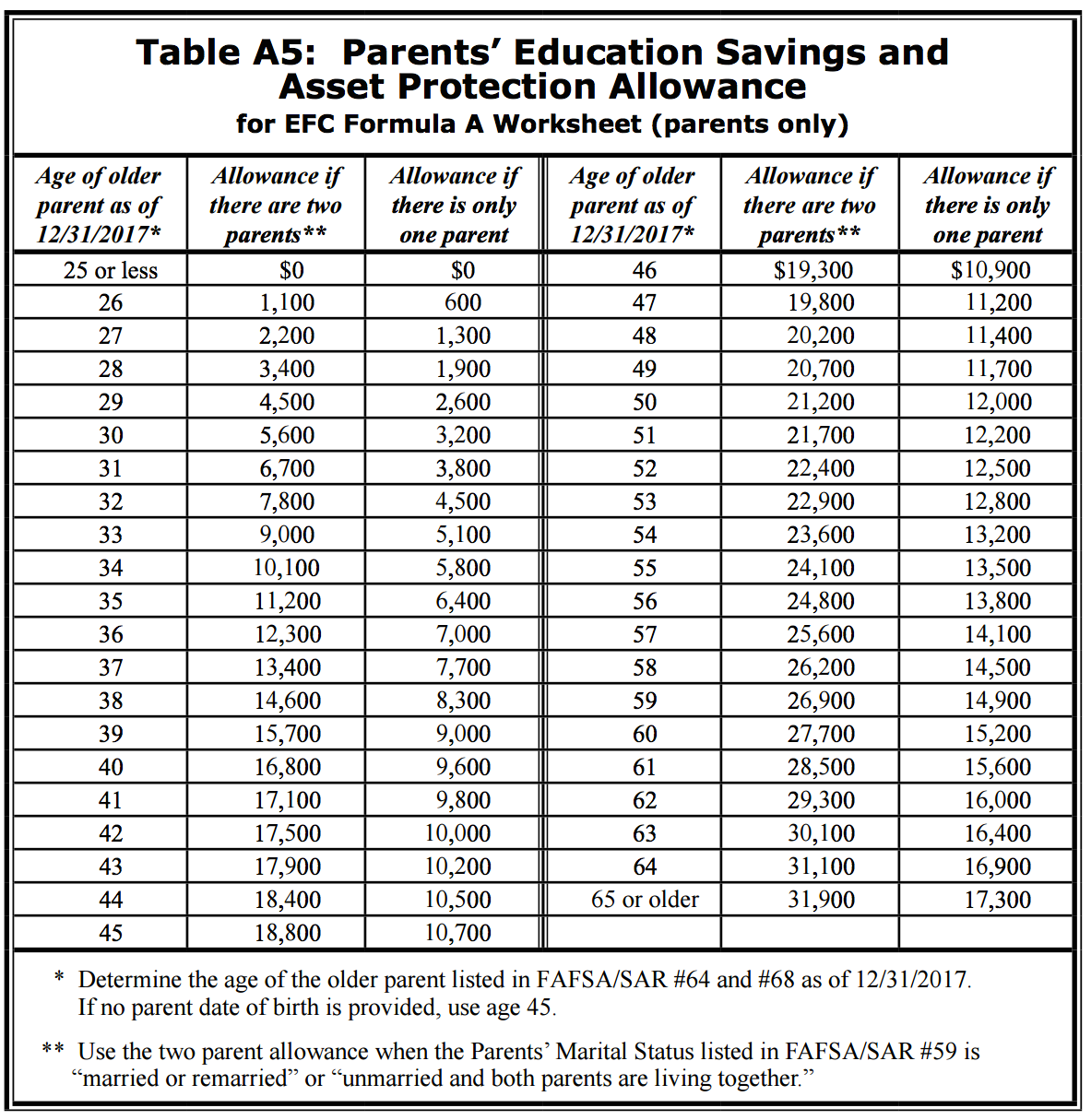

. But for parents there is a protection allowance of 30000 to 60000 based on the age of the oldest parent living in the students house. Its essential to understand how assets whether. UGMA UTMA accounts where you are listed as the custodian and do not own.

Separately it asks for income and tax return information from 2019. DONT include these investments as assets on the FAFSA. The FAFSA for the 2022-23 academic year opened on Oct.

Is a car an asset for FAFSA. The Free Application for Federal Student Aid FAFSA form asks for marital status as of today the day the form is filled out. The car also isnt reported as an asset on the FAFSA.

Retirement accounts are meant to be tucked away for later on in life so dont include them as assets. Do retirement accounts count as assets for FAFSA. The car loan is not relevant to FAFSA calculations and cars are not an asset for their purposes.

And distributions from it are student income in the year theyre received. NO its not an asset on the FAFSA but it is on the Profile. Other assets students and parents can leave off of the application include the value of.

Other investments are reported on the FAFSA application including bank accounts brokerage accounts and investment real estate other than the primary home. Qualified educational benefits or education savings accounts such as Coverdell savings accounts 529 college savings plans the refund value of 529 prepaid tuition plans. The home in which you live.

529s owned by your ex-spouse. You can also purchase items that your student will need for school. YES theyre an asset specifically the students asset.

UTMA or UGMA accounts. AAI is then subjected to the graduated rates up to 47. The value of life insurance.

The FAFSA for the 2022-23 academic year opened on Oct. If you read each question carefully you will see they want cash and investments like money markets stocks bondsno where do they ask about cars. As a general rule you should only report assets that are cash-based ie.

Can require asset information from applicants using the FAFSA if the applicants wish to also apply for nonfederal student aid with the FAFSA. The value of your life insurance. Cars computers furniture books boats appliances clothing and other personal property are not reported as assets on the FAFSA.

Trusts for which you or the student are a. A number of other FAFSA assets should not be listed. The FAFSA also isnt interested in having parents cash out their life insurance for their childrens education so dont include that information.

Clothing furniture electronic equipment personal computers appliances cars boats and other personal possessions and household goods are not reported as assets on the FAFSA and CSS Profile. Lets break that down a little bit. Any interest dividends or capital gains reported on the students income tax return is also counted as income on the FAFSA and assessed at 50 percent.

Custodial accounts are considered a students assets on the FAFSA. No the FAFSA specifically does not ask about cars boats planes jewelry retirement accounts and the family home. By doing this youll reduce your reportable assets.

Home maintenance expenses are also not reported as assets on the FAFSA since the net worth of the familys principal place of residence is not reported as an asset. If they will need a car or a computer for college consider buying it before you submit your FAFSA. 20 percent of a students assets are counted on the FAFSA 25 percent are counted on the CSS Profile.

Possessions such as a car a stereo clothes or furniture are not reported as assets on the financial aid application. Since youve probably heard that assets are assessed at 564 the way we reach that is 47 x 12. 10 rows An asset is essentially any money that you have readily available.

Other assets students and parents can leave off of the application include the value of cars and other vehicles such as boats or motorcycles. Below is a list of assets you do not need to include when filing your FAFSA. Sometimes they want to preserve assets for future use for something other than higher education such as down payment on a house or starting a business.

Reportable assets are based on the net worth after subtracting any debts that are secured by the asset. Sometimes families want to shelter assets on the Free Application for Federal Student Aid FAFSA to increase eligibility for need-based financial aid. The Contribution from Assets is added to the Available Income in the FAFSA formula to come up with Adjusted Available Income AAI.

The equity available in the home you live in. The value of retirement plans such as 401k. The PROFILE will ask about a family farm but once again schools will treat this asset will vary.

This would include 401K IRA pension funds and so on. But in many situations reporting your assets on the FAFSA is unavoidable. First its important to note that parental assets and the childs assets are treated differently on the FAFSA.

Not your car and liquid meaning you can easily turn them. YES theyre an asset. Any assets in the students name is assessed at a flat 20 percent rate.

The FAFSA opening date and FAFSA deadline is the same for everyone. An asset is defined as property owned by the family that has an exchange value.

How To Shelter Assets On The Fafsa

Just How Risky Is It To Lie On Your Fafsa Application College Finance

How To Shelter Assets On The Fafsa

Is My Car An Asset Or A Liability

The Fafsa Asset Protection Allowance Plunges To Near Zero

2017 Guide To College Financial Aid The Fafsa And Css Profile

Do My Savings Affect Financial Aid Eligibility Money

How Assets Can Hurt Your Student S Financial Aid Package Collegiateparent

What Is The Expected Family Contribution Efc For Financial Aid Eligibility Bautis Financial