owners draw report in quickbooks online

I know a way on how you can see the Owners draw balances in QuickBooks Online wk249. From the Account Type dropdown choose Equity.

How Can I Run An Owners Draw Report To See The T

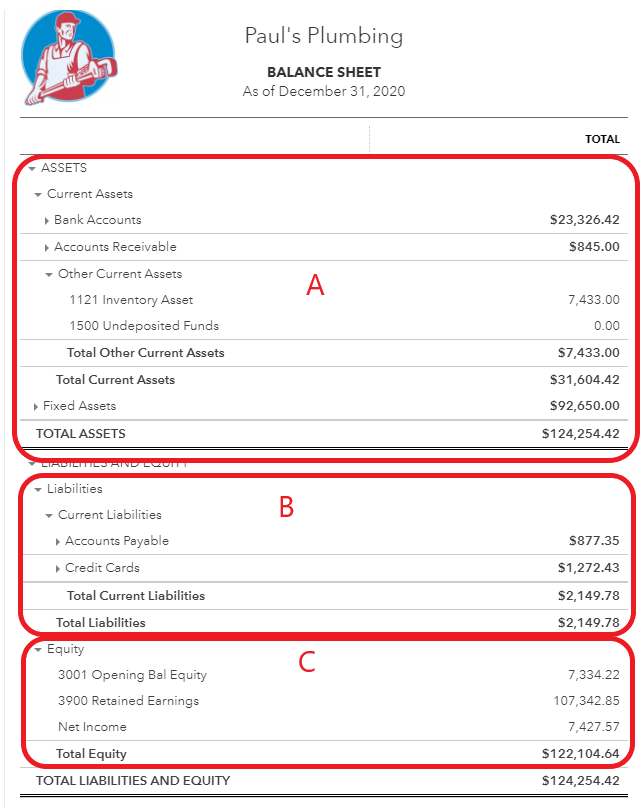

From an accounting standpoint owners draws are shown in the equity portion of the balance sheet as a reduction to the owners capital account.

. To do so you are required to select the option of Chart of account at the QuickBooks online homepage and click on the feature option and now open the new tab and move to the drop-down bar of Account Type and choose the Equity. Click on icon Select Bank Deposit. If you own a business you should pay yourself through the owners draw account.

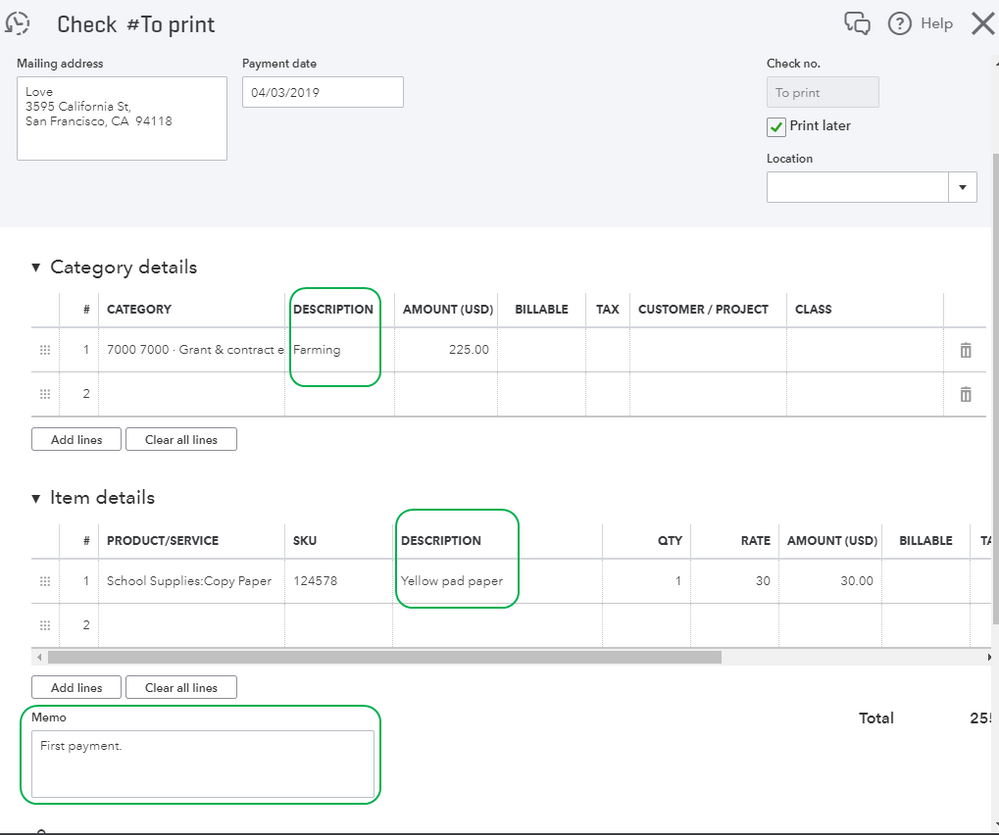

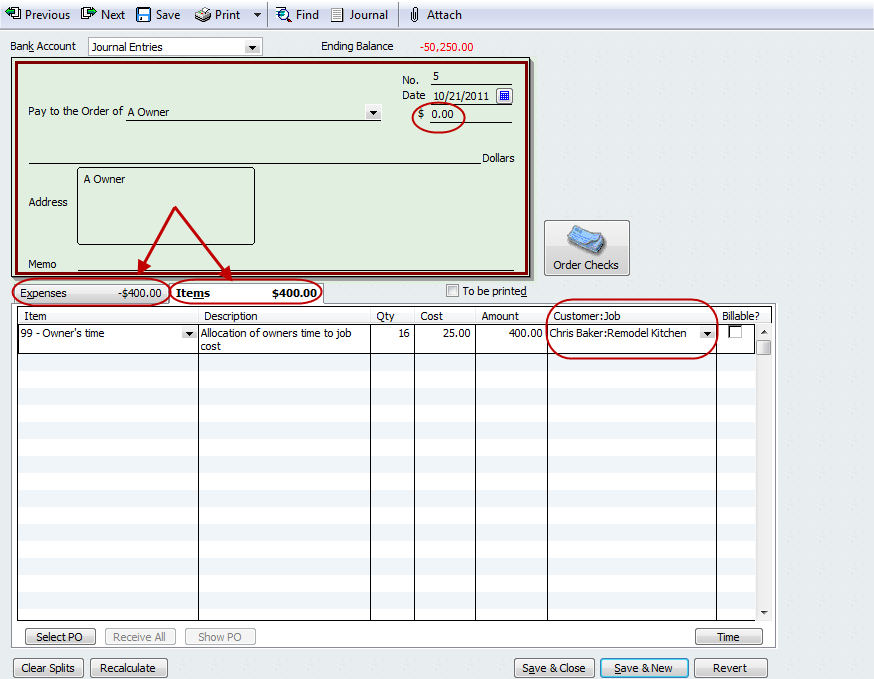

To Write A Check From An Owners Draw Account the steps are as follows. Enter the account name Owners Draw is recommended and description. Report Inappropriate Content.

If you have any video requests or tutorials you would like to see make sure to leave them in the com. This will handle and track the withdrawals of the companys assets to pay an owner. Enter and save the information.

With the help of an owners draw account you are enabled to record any kind of withdrawals from the bank account. Then choose the option Write Checks. Now enter the amount followed by the symbol.

To create an owners draw account. In the window of write the cheques you need to go to the Pay to the order section as a next step. How do I reflect Owners draw in Quicken.

Procedure to Set up Owners Draw in QuickBooks Online. Fill in the check fields. Now you need to choose the owner and enter an amount next to the currency sign.

Before you can record an owners draw youll first need to set one up in your Quickbooks account. Owners equity is also where a family living or draw account would be located if the business is providing for personal needs of the owners and an. In fact the best recommended practice is to create an owners draw.

In this section click on the Owner. In the Chart of Accounts window select New. The second way to view the balance is to run the Balance Sheet Report scroll.

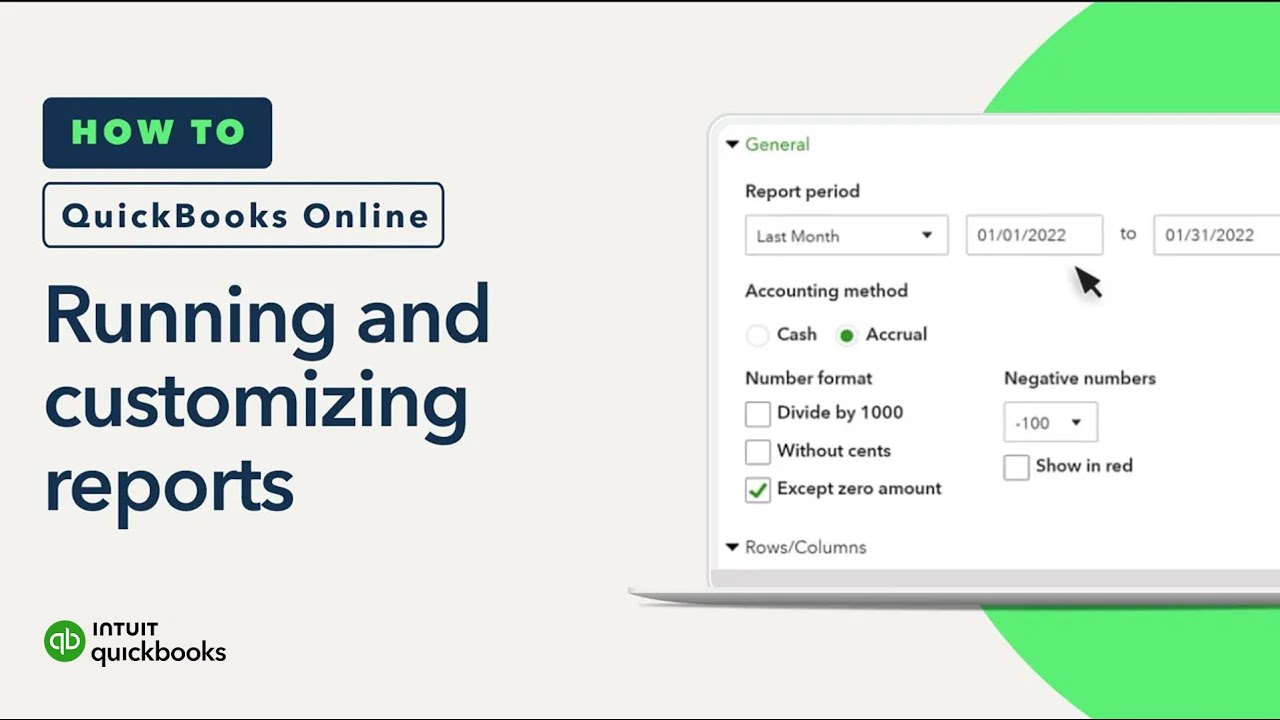

Learn about Recording an Owners Draw in Intuit QuickBooks Online with the complete ad-free training course here. There are three ways on how you can see the balances for both equity and sub-accounts in QuickBooks Online. Go to Settings and select Chart of accounts.

Only a sole proprietorship a partnership a disregarded entity LLC and a partnership LLC can have owner draws. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. Smith Draws Post checks to draw account.

Steps to record owner investment in quickbooks. Dont forget to like and subscribe. When recording an owners draw in QuickBooks Online youll need to create an equity account.

If youre interested in learning more about owners draw and how to set them within Quickbooks keep reading. Create an Owners Equity account. Know that you can select the equity account when creating a check for the owner.

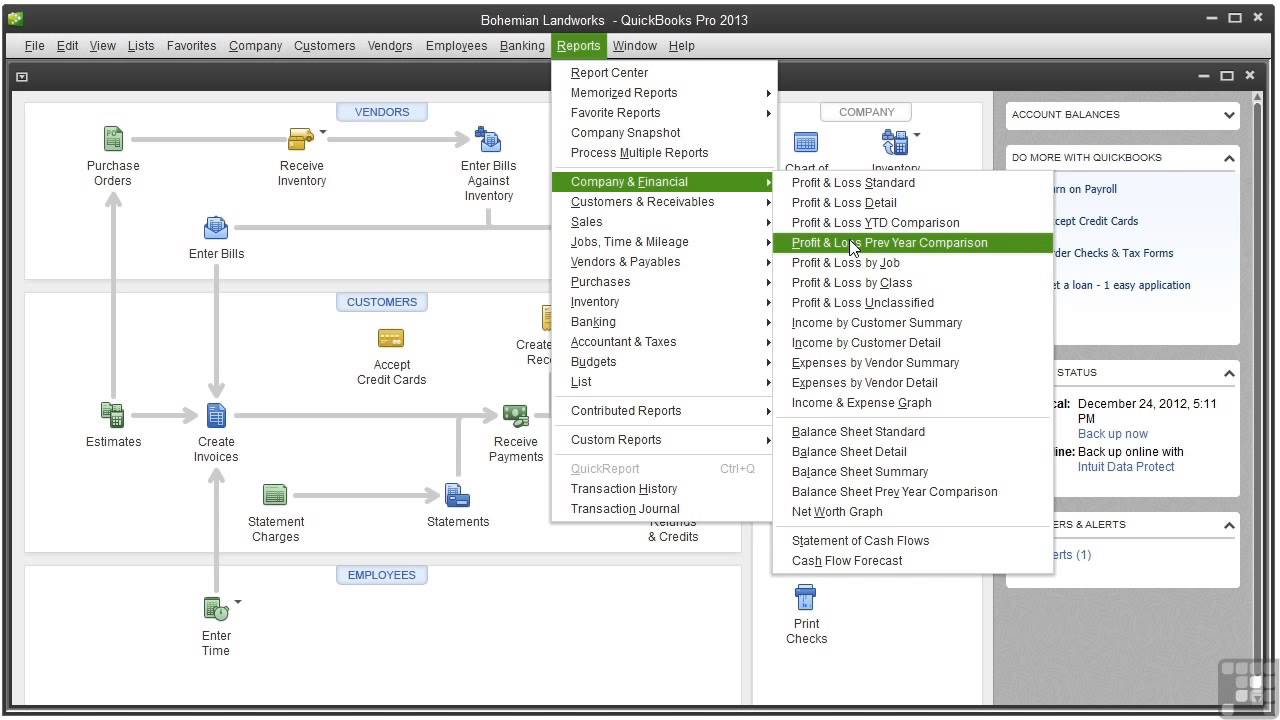

Make sure you use owners contributionsdraws equity vs. Visit the Lists option from the main menu followed by Chart of Accounts. This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask.

For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a partnership. In QuickBooks Desktop software. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner and name them by owner eg.

Windows How do I reflect Owners draw in Quicken. This way the said transaction will show up under the Equity account of your Balance. Below are the steps to Record Owner investment in quickbooks.

People who searched pasiones tv novelas also searched 8Q Las mejores novelas turcas en español gratis disfruta de tus series y telenovelas. Open the chart of accounts use run report on that account from the drop down arrow far right of the account name. Setting Up an Owners Draw.

October 15 2018 0559 PM. Before you can pay an owners draw you need to create an Owners Equity account first. Click on the Banking menu option.

When entering a check written to the owner for personal expenses post the check to her draw. Corporations should be using a liability account and not equity. To create an owners draw account.

At the bottom of the Chart of Accounts page you should see an option titled Accounts click it and choose New. From the Accounts Drop Down menu select the bank account in which you want. At the bottom left-hand side of the screen youll see a menu with Accounts.

First you can view the accounts balances by viewing their register. Heres how you create an Owners Equity account. Is there a better way to do this.

When you put money in the business you also. We also show how to record both contributions of capita. I used to use Quickbooks but have transitioned to Quicken and the account I set up for Owners draw is reporting as Unspecified Business Expense.

In QuickBooks Desktop software. Click on the Banking and you need to select Write Cheques. If your business is formed as a C Corporation or an S Corporation you will most likely receive a paycheck just like you did when you were employed by someone else.

In this QuickBooks Online tutorial youll learn how to record owners personal expenses paid with company funds along with- Learn about and set up equity ac. In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks. Then choose the option Write Checks.

To create an owners draw log into your Quickbooks account and access Lists Chart of Accounts. At the bottom left choose Account New. Select Equity and Continue.

Setting Up an Owners Draw Account. The Owners draw can be setup via charts of account option. Enter the account name Owners Draw is recommended and description.

Owner draw report quickbooks Monday March 7 2022 Edit. In the Write Checks box click on the section Pay to the order of. Choose Lists Chart of Accounts or press CTRL A on your keyboard.

2 Create an equity account and categorize as Owners Draw. Select Chart of Account under. 1 Create each owner or partner as a VendorSupplier.

Click Equity Continue. Click Save Close. First of all login to the QuickBooks account and go to Owners draw account.

Expenses VendorsSuppliers Choose New. Due tofrom owner long term liability correctly.

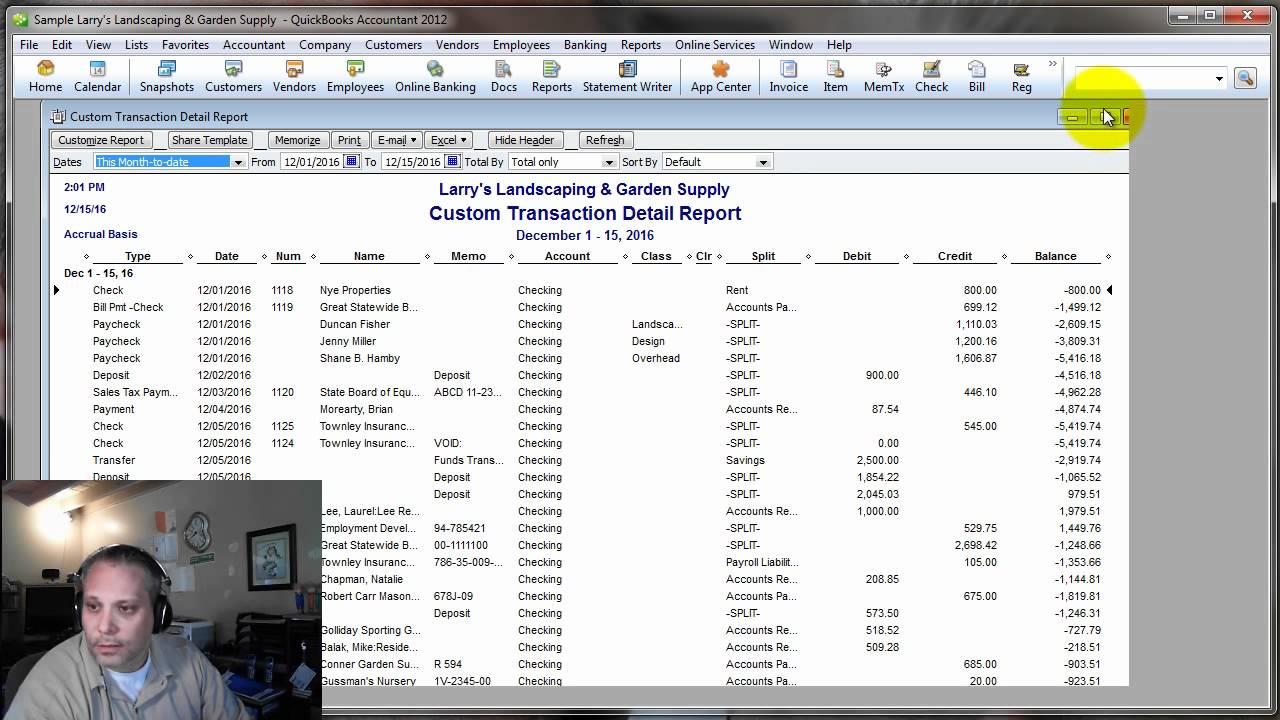

Quickbooks Help How To Create A Check Register Report In Quickbooks Youtube

Solved Transaction Detail By Account Report

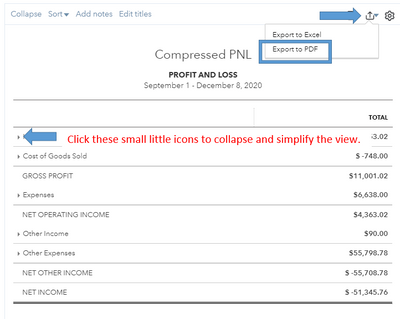

Solved Custom Profit And Loss Report

Solved Transaction Detail By Account Report

Quickbooks 2013 Tutorial Profit And Loss Report Youtube

How To Run Reports In Quickbooks Online Youtube

How To Save Customized Reports In Quickbooks Online Tutorial Youtube

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

Why Is My Quickbooks Profit And Loss Report Not Showing Owner S Draw Quickbooks Tutorial

Oh Quickbooks You Truly Know The Way To My Heart Is A Big Green Check Mark Office Work Is The Least Glamor Quickbooks Online Quickbooks Small Business Owner

How To Create A Balance Sheet In Quickbooks Online

How To Run And Customize Reports In Quickbooks Online Youtube

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

Onpay Payroll Services Review Payroll Software Payroll Advertising Methods

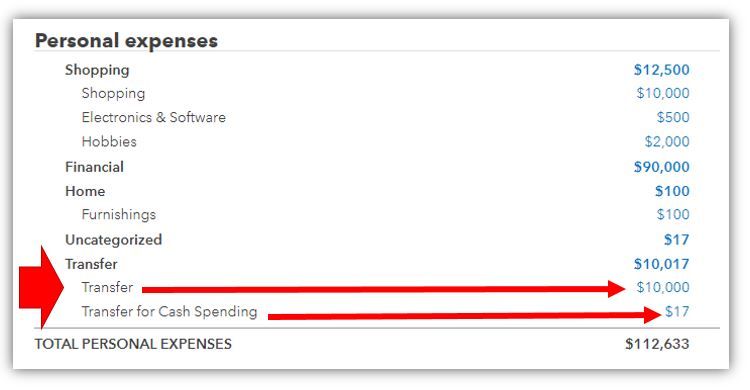

Solved Owner S Draw On Self Employed Qb

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc